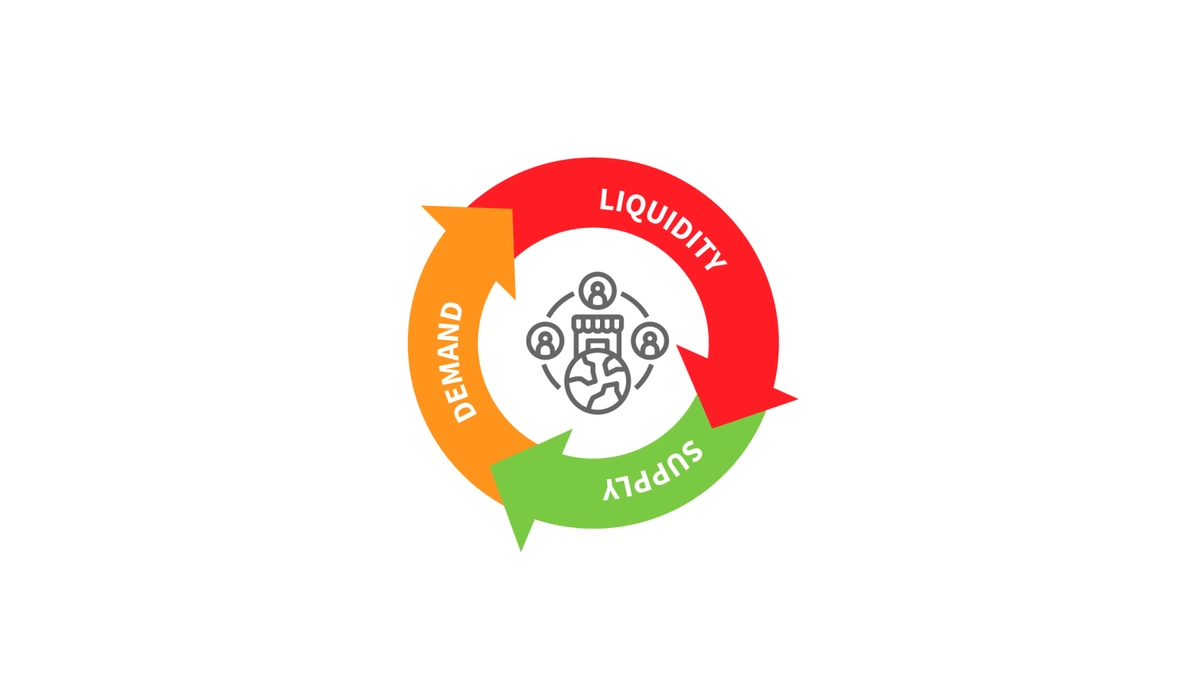

The survival of an early market economy depends on its ability to solve the cyclical dependency of demand and supply until a healthy equilibrium can be achieved to unlock its network effects.

By solving for either side of the equation, we can create the right conditions to achieve equilibrium. Our goal with this article is to share our learnings by providing a framework for bootstrapping marketplaces in any industry challenged with underutilization of resources; and we achieve this by rewarding sellers for network contribution, enabling the creation of incentives to attract buyers.

A True Free Market

A free market is a system in which the prices for goods and services are determined by the open market and by consumers. In a free market, the prices for goods and services are set freely by the forces of supply and demand and reach their point of equilibrium without intervention by external forces.

…the obvious and simple system of natural liberty establishes itself of its own accord. Every man…is left perfectly free to pursue his own interest in his own way…. The sovereign is completely discharged from a duty [for which] no human wisdom or knowledge could ever be sufficient; the duty of superintending the industry of private people, and of directing it towards the employments most suitable to the interest of the society

— Adam Smith, The Wealth Of Nations, Book IV, Chapter IX

For a market that relies on network effects to unlock value, it’s critical to sustain demand or supply until equilibrium is achieved. We’ll present a model where an inflationary system is leveraged to create the effects of liquidity (counterparties at a reasonable price) and bootstrap demand.

For a truly free market to be possible, it’s critical that the market remains permissionless and self-sovereign with an open ecosystem or risk market-failure.

-

Permissionless: Participation does not require anyone’s permission.

-

Self-Sovereign: The price of goods and services is driven purely by market forces and not external forces. Monetary policy that dictates the value of the currency used in the market should be determined by its stakeholders and not external forces.

-

Open Ecosystem: The incentives are distributed fairly to all the participants in the market so they benefit from the prosperity of the market.

Background

This article is derived from Akash’s Economic Model. Akash is a permissionless, open, and secure marketplace to trade unused compute cycles.

Akash’s interoperability layer radically simplifies integration with decentralized cloud networks, such as NuCypher, Storj, and Handshake. Each of these systems performs a unique function in an overall solution for a decentralized application.

To enable a friction-free exchange of value and provide more liquidity, which is essential for automation, Akash enables transacting in a multitude of currencies such as BTC, XRP, ATOM.

The full potential of Akash Network is unlocked when the system reaches economies of scale. Until then, Akash has to not only sustain supply but also offer compelling incentives to attract buyers. By leveraging this model, Akash is able to offer compute at 10x lower cost than developers are paying in the market — an extremely attractive value proposition for data-intensive applications.

Economic Security by Monetary Sovereignty

If money is an abstraction that measures value, it’s essential the monetary policy — that influences the value of money itself — should act in the best interest of the market it serves.

A native digital currency (token) — whose value is driven purely by market forces — can provide economic sovereignty when monetary policy is determined by a market’s stakeholders.

By enabling permissionless commerce without the influence of external forces, a token can be leveraged to establish the economic integrity of the marketplace in low trust environments. Strangers can transact directly with one another without an intermediary (external force) arbitering trust — truly enabling internet scale.

This is possible by using a system like Proof-of-Stake (PoS), where the token utility is augmented with the ownership of the network. In a PoS system, the nodes “stake” tokens (collateral) to transact on the blockchain and the chain that represents the majority of the tokens is considered the honest-chain. Each token holds a vote.

For example, in a PoS algorithm like Tendermint, anyone can propose to write to the blockchain as long as 2/3rd’s of the validators approve the transaction. A validator’s voting power (weight) is based on the number of tokens they hold (or the number of tokens delegated to them).

PoS networks such as Cosmos, Kava, and Akash offer on-chain governance models. On-chain governance enables the token holders to have ultimate sovereignty over all aspects of the protocol. The “stake” can also be used as collateral to disincentivize bad behavior.

Subsidizing Supply using Inflationary Rewards

The maintainers of the blockchain can be incentivized using a Proof-of-Stake scheme. The incentives could include mined tokens (by means of inflation) and usage fees collected by the network.

To sustain the market value of the token and attract sufficient liquidity, the value of the token should be derived from its earning potential. Earning potential could be based on commission or subscription-based models. For example, in Akash, the Akash Token (AKT) holders earn income from transactions and usage fees (make and take).

The network has to offer value (beyond inflation) to its stakeholders or risk insolvency.

In the early stages of a market economy, when there is no demand-supply equilibrium, there isn’t sufficient demand to attract supply (which in turn affects the buy-side). To solve such a cyclic dependency, the seller can be incentivized for their contribution to the network, in addition to earning income from selling goods in the market.

The seller earns income regardless of demand. When that additional income can generate expected margins (as when goods are sold), the seller can offer goods at an exponentially lower cost without sacrificing margins to attract demand.

By effectively de-risking seller participation, we can offer a highly compelling value proposition to attract buyers.

Rewards based on contribution

Since staking provides economic security to the chain (a critical function of the network) anyone who stakes tokens is eligible to receive a share of the overall income. To encourage long-term participation, stakers who commit to longer terms receive a high portion of the reward compared to stakers who commit to short terms.

As a primary objective to ensure supply, a staker’s compensation also depends on the supply they commit to the network. Stakers who sell goods or services receive more income than stakers who are not selling but contributing to economic security.

For example, in Akash, a staker can earn anywhere from 56% APR to 176.5% APR depending on tokens locked up, time committed, and various mining strategies (liquidate mining compensation or re-stake mining compensation).

In summary, a staker’s contribution is measured by:

-

Locked Tokens: the number of tokens they stake.

-

Trade Factor: the amount of goods they sell.

-

Lockup Time: how long they’re committed to the network.

The income generated by the network (staking rewards and usage fees) goes into a pool which is distributed to the miners based on their contribution factor.

A Self Regulating Inflation System

Since the goal of the inflation system is to bootstrap the market until a healthy economic equilibrium can be achieved, the inflation rate should asymptotically reach zero on reaching this threshold. The time it takes to reach zero-inflation is variable, as it depends on inflation at a given time. Higher inflation means it’ll take less time to reach zero.

The inflation rate also depends on lock-up times. Shorter lockup times lead to lower inflation. A self-adjusting inflation rate based on time commitment is critical to providing adequate price-support. In bear markets, when stakers commit for shorter time frames, a lower inflation rate leads to less price pressure. The initial inflation rate should be determined by the desired growth rate of the network. A self-regulating inflation rate based on performance ensures a healthy market value for the token.

Annual inflation over the years when tokens are locked with long and short commitments

In Akash, initial inflation is expected to be 100% APR (with an assumption of 60% of lockup for a year) and asymptotically reaches zero in approximately ten years. Under these conditions, a compute provider offering a server rack is able to generate an income of $790,294 with a net profit of $166,777 in three years by staking $207,972 without having to sell any capacity.

Effects of Liquidity

A model that grows with inflation relies on attracting sufficient liquidity for the token to retain meaningful value for facilitating trade. the market value of the token is determined by investors speculating on the future earning potential of the token, and the system needs to incentivize investors (speculators) to buy-in.

This system also minimizes the concentration of wealth – any non-functioning tokens that do not contribute to the essential functions of the ecosystem are taxed by means of inflation. This ensures the efficiency of the economy and discourages pure speculators who hold on to tokens for self-gain without making any meaningful contributions to the prosperity of the network.

In Akash Network, the Akash Token (AKT) is specifically designed to achieve economic security, incentivize early adoption, and normalize exchange rates. Any AKT not involved in the intended use cases risk dilution of value, given market capitalization remains stable. The fees may be settled in a multitude of tokens, including AKT. AKT holders, however, are discouraged from using it for settlement considering its illiquid nature.

Conclusion

At Akash, we believe that by using the power of a free market, we can unlock 85% of capacity in 8.4 million data centers currently underutilized today. We created the tools to activate an incentive structure that not only fairly distributes but will unlock network effects to accelerate growth.

Please subscribe to our newsletter to stay informed on future articles that might interest you. Also, find us in our community if you’d like to continue the conversation.