Proof of Stake (PoS) mechanisms are steadily expanding in their use across a variety of blockchain applications. Superiority in their energy efficiency, lower barriers to entry, and governance aspects like a lower tendency for centralization make PoS an increasingly popular alternative to Proof of Work (PoW), which is leveraged to reach consensus in current iterations of Bitcoin and Ethereum, for example.

Staking market capitalization is approaching $18 billion, an 18-month high, with the total value locked in staking at an all-time high of over $11 billion. About 50% of the highest-valued cryptocurrencies by market cap are utilizing a PoS mechanism. Several major projects are in progress to transition into PoS, for example, Ethereum. These developments are driven by a number of advantages that PoS brings compared to the historically more dominant Proof of Work algorithms.

Reaching Consensus, from Work to Stake

In blockchain, a consensus mechanism ensures that every transaction on the blockchain is verified and all participants in the blockchain agree on the status of the ledger. There are various consensus mechanisms in use today. Among the most predominant ones are Proof of Work (PoW) and Proof of Stake (PoS).

PoW requires the solving of a complex, computation-heavy problem before new transactions can be added to the blockchain. Participants with the highest computing power have the highest probability of solving the problem and thus securing the next block.

PoW is very energy-intensive to operate, and resource consumption only intensifies as networks scale in adoption and number of transactions. Bitcoin alone is exceeding the annual energy use of a number of sizable nation states. Additionally, PoW blockchains tend to centralize, mainly driven by economies of scale in the establishment of computing power needed for mining.

The heavy resource and energy requirements and disadvantages of PoW have increased the popularity of Proof of Stake (PoS) consensus.

The Benefits of Proof of Stake

PoS assigns validation of the next block of transactions on the blockchain to a participant based on the number of tokens held. Instead of focusing on computing power, participants are incentivized to maximize their staked token holdings in the blockchain’s currency. Fairness is ensured through coin-age based selection or randomization processes.

Following are key differences between PoS and PoW:

- Energy efficiency: With Proof of Stake, there isn’t a collective rat race to solve a complex, heavy-compute problem. As a result, PoS is significantly more energy efficient as a consensus mechanism than PoW.

- Decentralization: PoW fosters concentrated investments in computing power. Joining a mining pool unlocks exponential rewards for individual miners, as the concentrated mining capacity enables a disproportionately higher probability of mining the next block. In PoS, rewards are linear to the proportion of staked coins. This may lead to some centralization, but with much lower incentives than PoW.

- Security: In PoS networks, a bad actor would have to own 51% or more of the staked tokens to manipulate the network. This implies that the initiator of a network manipulation would also be the most negatively impacted by the damage. Further, controls like slashing of the invested stake of a bad actor removes all incentives for such behaviors.

- Currency stability: In PoS networks, new transactions are validated by the participants most invested in the staking currency. As a result, holding and staking the network’s currency is incentivized. This contrasts to PoW networks, where heavy investments in compute power and energy are required. These investments require fiat currency, and miners have to withdraw network tokens for conversion, causing downward pressure on token valuation.

A New World of Reaching Consensus

A number of compelling blockchain projects are leveraging PoS mechanisms to secure their networks, prevent centralization, and increase speed of consensus:

Ethereum has been working on a transition from PoW to PoS for several years, with a first public draft spec of their Casper consensus protocol published in 2017. The main drivers for this transition are the centralization tendency and heavy energy consumption of PoW. Ethereum’s Casper protocol will integrate a slashing mechanism to better secure the chain.

EOS is running a delegated PoS algorithm to manage the consensus process. Delegates are selected through a continuous approval system to lead consensus. By reducing the number of validating parties through delegation, new blocks of transactions can be verified in shorter time intervals.

Tezos uses a liquid PoS algorithm that leverages both direct and delegated voting to achieve consensus. Participants with staked currency can vote directly or delegate their voting responsibilities. Through delegation, this model becomes highly scalable, as any participant who isn’t able to submit a vote can simply delegate their vote.

In the Cosmos Network, where the Tendermint engine handles networking and consensus for each blockchain, the application layer defines the validator set. A public blockchain on Cosmos leverages a PoS mechanism if its validators are elected based on the number of coins they hold (as opposed to a private blockchain where validators are appointed by the application).

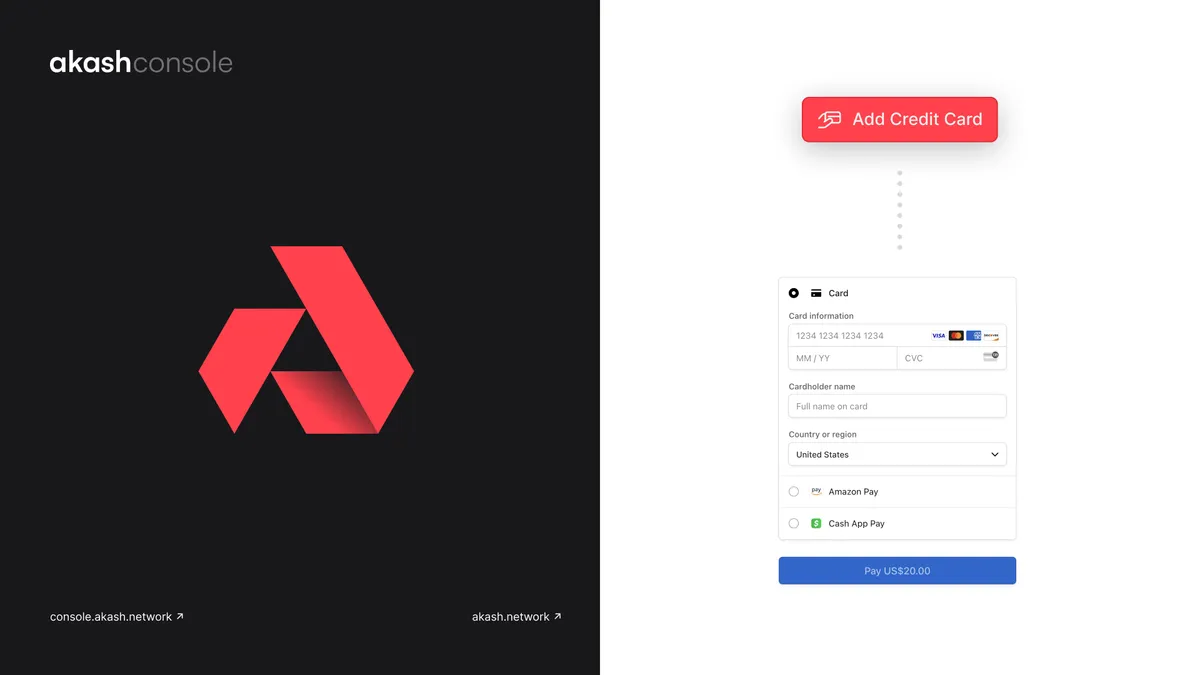

As part of the Cosmos ecosystem, Akash Network also leverages PoS in the form of a native currency to solve for volatility (one of the biggest challenges for adoption in crypto) while ensuring economic security of our public blockchain. The core utility of our Akash Token (AKT) acts as a staking mechanism to secure the network and normalize cloud compute prices for Akash’s marketplace auction.

The amount of AKTs staked towards a validator defines the frequency by which the validator may propose a new block and its weight in votes to commit a block. In return for bonding (staking) to a validator, an AKT holder becomes eligible for block rewards (paid in AKT) as well as a proportion of transaction fees and service fees (paid in any of the whitelisted tokens).

Opening Access for Staking Incentives

In addition to stabilizing blockchains, participants in PoS blockchains can make money by staking coins. In exchange for locking up tokens, the token holders receive incentives based on the amount they stake and other parameters. At Akash, we also distribute incentives based on the length of time Akash Tokens (AKT) are locked up.

Token holders can stake the project’s tokens via a wallet, staking pool, or exchange. As new blocks are created, stakers receive staking rewards. Rewards vary for different tokens. Across 70+ tokens, Staking Rewards is tracking an average return of 13.4%.

More and more instruments are created to support staking, ranging from specialized wallets to staking pools. These tools focus on addressing the main barriers to entry for new participants, in particular security and ease of use.

In a standard PoS mechanism, stakeholders need to always be online to be eligible to produce a new block. This drives heavy power consumption and increases the risk of hacker attacks.

Through staking pools, token holders don’t have to be online continuously. The pools need to ensure that the foundation is well controlled and block production is secured. The disadvantages to staking pools are higher risk for hacking and the lack of guidance on taxation.

What’s Next for Proof of Stake

The advantages of Proof of Stake over Proof of Work mechanisms, in particular energy efficiency, scalability, and lower tendency to centralization, have led to a rapid rise of PoS networks.

Any residual concerns about the security of PoS blockchains, as they have not been exposed to the historically high transaction volumes of PoW, are getting addressed with continuous refinements and development in the ecosystem.

Staking PoS blockchains and reaping investment benefits is becoming easier and more secure through wallets, staking pools, and exchanges, significantly lowering the barrier to entry for new participants. To support a rising number of applications and a steady increase in transaction volume, the proliferation of PoS is a critical step towards sustainability, scalability, and continued decentralization of the blockchain.