What is a Token?

In the blockchain ecosystem, a token is an asset that represents a certain value, stake, or voting right and one that can be digitally transferred between two people. Tokens serve as incentives that are usually sold by a company through a public sale (Initial Exchange Offering), or as a reward for user behavior that benefits the issuing platform.

Specific rights awarded to a token holder include[efn_note] S+C Intelligence, Token Rights: Key Considerations in Cryptoeconomic Design.[/efn_note]:

- Profit or fees: A token can entitle its holders to a portion of fees or profits from using the network. It’s similar to a company stock, though generally such tokens do not assign voting rights.

- Access rights: Tokens can be used to determine access to a network and to pay transaction fees. Usually they are not the sole means of payment and other currencies can be used, but small amounts of the specific token are required to use the platform at a minimum.

- Governance rights: This type of token entitles its holders to influencing the direction of the platform/protocol, including feature selection, vendor selection, etc. It is a basic feature of distributed autonomous organizations.

- Block creation rights: This type of token is most commonly found in a proof-of-stake system. Token holders can become block validators, and their chances to become the validator roughly equal to their proportion of tokens staked.

The Primary Types of Tokens

At a higher level, tokens are generally categorized along the following types. Based on their categorization and the financial interest involved, they are treated differently by regulatory bodies.

Payment tokens are synonymous with cryptocurrencies. They don’t have further functions or links to other development projects. Tokens may in some cases only develop the necessary functionality and become accepted as a means of payment over a period of time. Examples for payment tokens include Bitcoin (BTC) and Ethereum (Ether).

Utility tokens are intended to provide digital access to an application or service. They help in building an internal economy within the system, e.g., by rewarding its users to verify transactions within the blockchain. Utility tokens can give the holders the opportunity to vote on the network’s overall stability and security.

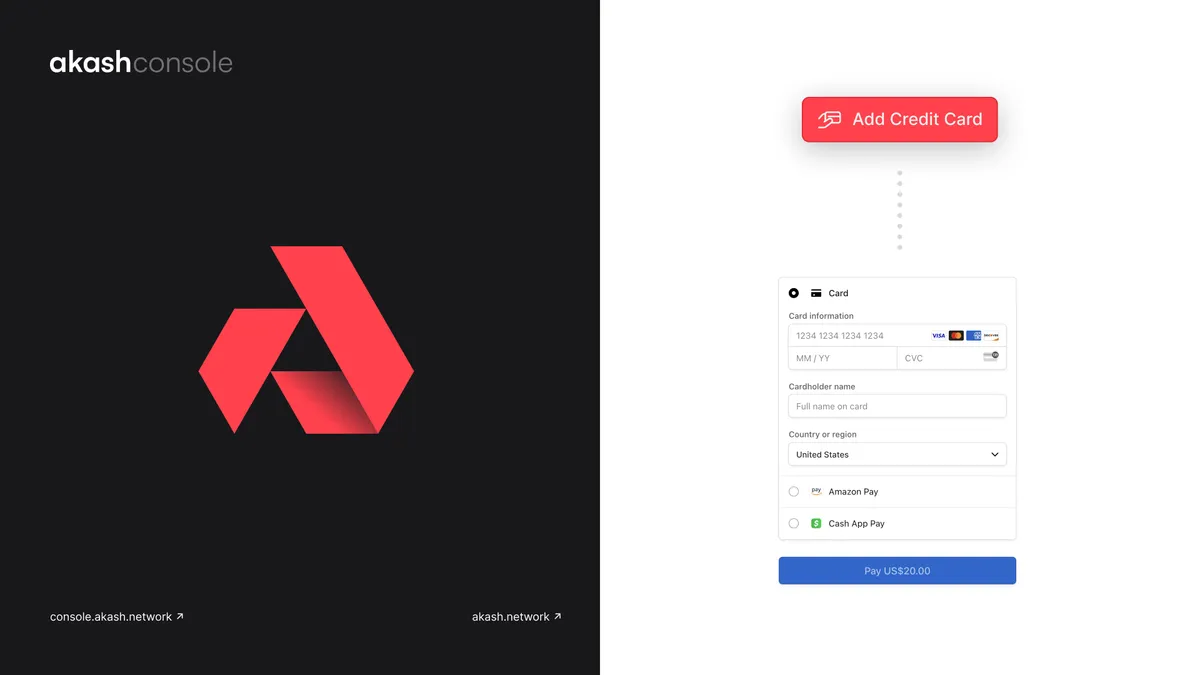

Utility tokens do not fall under securities treatment from a financial and tax perspective. However, with limited token supply and relevant utility of the token, its price can increase significantly due to supply-demand discrepancies. Examples for utility tokens include Basic Attention Token (BAT) and Akash Token (AKT). At Akash, AKT is core to our token economic model, and leveraged to secure and scale our distributed cloud computing marketplace.

Security, or asset tokens award a token holder the right to implement investment interests, e.g., by participating in a legal entity’s earnings streams or via receiving dividends or interest payments. To determine whether a token falls into this category, the Howey test is applied: If a transaction is an investment of money in a common enterprise and there is an expectation of profit from the work of the promoters or third party, then the underlying token is a security token[efn_note]https://www.investopedia.com/terms/h/howey-test.asp.\[/efn\_note\].

In terms of their economic function, the tokens are analogous to equities, bonds or derivatives. Like traditional financial instruments, they are regulated by the U.S. Securities and Exchange Commission[efn_note]https://www.sec.gov/ICO.\[/efn\_note\]. Examples for security tokens include Blockchain Capital (BCAP) and Science Blockchain (SCI).

How Tokens are Used in Blockchain

Issuing tokens enables a platform to raise the funds necessary to implement projects, and it can also engage individuals with the projects over time. Tokens may be used to validate transactions and create new blocks on a blockchain.

For example, platforms that leverage a proof of stake consensus mechanism require the staking of tokens to verify transactions. In return for commiting tokens to staking, individuals receive staking rewards and potentially a share of transaction fees from the platform’s offering[efn_note]https://blog.akash.network/2020/02/11/brave-new-world-of-staking-a-primer-on-proof-of-stake-pos/.\[/efn\_note\].

The Rise of Initial Exchange Offerings (IEO) and Security Token Offerings (STO)

The landscape of token offerings has changed significantly in the past few years. During 2017 and 2018, a large number of Initial Coin Offerings (ICO) took place. Companies were able to raise $5+ billion in 2017 and $20+ billion in 2018 through ICOs. ICOs have significantly declined in frequency and valuation, due to concerns about lacking due diligence, investor protection via regulation, and even fraudulent activities[efn_note]https://fortune.com/2018/05/12/ico-blockchain/.\[/efn\_note\]. As a result, the number of ICOs declined over 70% in 2019, and the amount raised dropped by over 90% compared to 2019.

At the same time, Initial Exchange Offerings (IEO) and Security Token Offerings (STO) have significantly increased in popularity.

In IEOs, tokens with a specified use case such as accessing the blockchain’s solution or verifying its transactions, are offered through an exchange, rather than directly to investors. This ensures that the exchange performs due diligence before listing the token, thus ensuring that dodgy tokens are weeded out. After the IEO, tokens should be immediately tradeable[efn_note]https://thenextweb.com/hardfork/2019/03/21/initial-exchange-offering-ieo-ico/.\[/efn\_note\].

In STOs, the use case for a token doesn’t have to be specified in detail, all tokens are backed up by specific assets. Tokens additionally offer legal rights such as voting and revenue distribution, and are subject to regulation. In essence, security tokens are investment contracts that represent legal ownership of a physical or digital asset, and the blockchain is used to verify ownership.

The key difference between IEOs and STOs is that IEOs are for projects that launch utility tokens, which allow the token holder to leverage the network they are issued on and to participate in voting. STOs on the other hand are very similar to traditional investment contracts. In short, STOs have to pass the Howey test, while IEOs have to fail it.

Both IEOs and STOs have shown strong growth in recent years. Binance, the largest cryptocurrency exchange in the world in terms of trading volume, pioneered token sales via IEOs, with highly successful initial token sales starting in late 2018. In the first half of 2019 alone, IEOs increased by 6000% to over 120, via 15+ launchpads. The first STO took place with Blockchain Capital in 2017. Since then, the annual count of STOs jumped from 5 in 2017 to 35 and 55 in 2018 and 2019, respectively[efn_note]https://blockstate.com/global-sto-study-en/.\[/efn\_note\].

The wide ranging impact of ICO busts in 2017/2018 brought valuable learnings to token offerings, reflected in IEOs’ and STOs’ improved transparency, security and liquidity. With the accelerating adoption of proof of stake consensus, more organizations are adopting novel ways to leverage token economics to build and scale their networks.