The Basics: Why Does Crypto Matter?

Cryptocurrencies are important because they allow instantaneous, private and secure transactions between individuals located anywhere in the world without relying on large financial institutions. The implications of this technology have far-reaching consequences and represent a revolution that is spreading into new areas and causing significant innovation.

Whether or not you are directly impacted by crypto today, there is a high likelihood that you will be in the future. Explaining the full significance of the phenomenon would be impossible in a short blog post.

What Can Crypto Do For You?

Here is a list of potential benefits that cryptocurrency can offer you, as a user:

- Earn a living buying, swapping, selling cryptocurrencies.

- Earn passive income, compounding interest and high yields through a wide variety of “Decentralized Finance” (DeFi) technologies.

- Purchase digital property which can accumulate significantly in value via NFTs.

- Effortlessly and rapidly transfer value to people in your network instantly.

- Buy real-world items with your earnings such as houses, cars or travel.

- Get a job working for a decentralized autonomous organization (DAO) that pays you based on your contributions and output rather than your credentials or job title.

- Create and sell digital goods and profit from them in new ways, without any “middlemen” taking the majority of your profit.

Regulatory and Legal Concerns

If you follow the conversation around Cryptocurrencies on social media, you will receive mixed signals. Some people think Crypto is all a giant scam. Others believe they will be regulated out of existence. Still, others think that cryptocurrencies only offer value to criminals in the form of money laundering (or worse). Finally, a large and passionate group of dreamers believe that cryptocurrencies are a true revolution that will completely reshape the modern world for the better.

The reality is that cryptocurrencies are a permanent shift in the fundamental nature of money and will disrupt the entire world economy. The speed of innovation and creativity of entrepreneurs working in crypto has shown that this is an innovation with far-reaching and permanent consequences. Regulatory activity tends to follow technological innovation, and global governments are responding by adapting to this change with new laws and regulations.

Cryptocurrencies unlock many new types of financial transactions not previously possible for individuals. With cryptocurrencies, it is possible to take out loans against funds stored in a DAO, for example. I recommend reading up on the topic of taxes for cryptocurrencies or loans extensively before engaging in any significant activity. Here are some guides to get started.

For the most part, the simple “buying and selling” of cryptocurrencies are all you need to worry about and these are taxed using standard calculations. It is important, however, to have some understanding of the regulatory and tax environment in advance. A common practice is to keep a spreadsheet of any trading activities to track cost-basis for tax purposes. There is a growing ecosystem of services to help automate tax tracking such as ZenLedger.

Step 1: Get A Wallet (And Lock It Down)

The starting point for most people’s journeys into crypto will begin with setting up a wallet to store their funds in. There are dozens of wallets available. Below are a few interesting ones worth investigating:

- Klever (really simple, easy to use iOS wallet)

- MetaMask (works with a very wide range of the decentralized applications (dApps) out there)

- Trust Wallet

- Coinbase Wallet

- Ledger

- Crypto.coin

- Keplr

Depending on which tokens or coins you want to experiment with, you may need to download or make use of different wallets. You can find a recent list of wallets here.

There are also “hot” and “cold” wallets. A “hot wallet” is a wallet that is connected actively to the internet and enables transfer into and out of it via a connected service. A “cold” wallet is a wallet that is stored offline. In most situations, “cold” wallets are a measure taken to avoid hacking or theft of the funds being stored. Hot wallets are considered to be less secure and more prone to hacking or theft. You can read more about wallet security here.

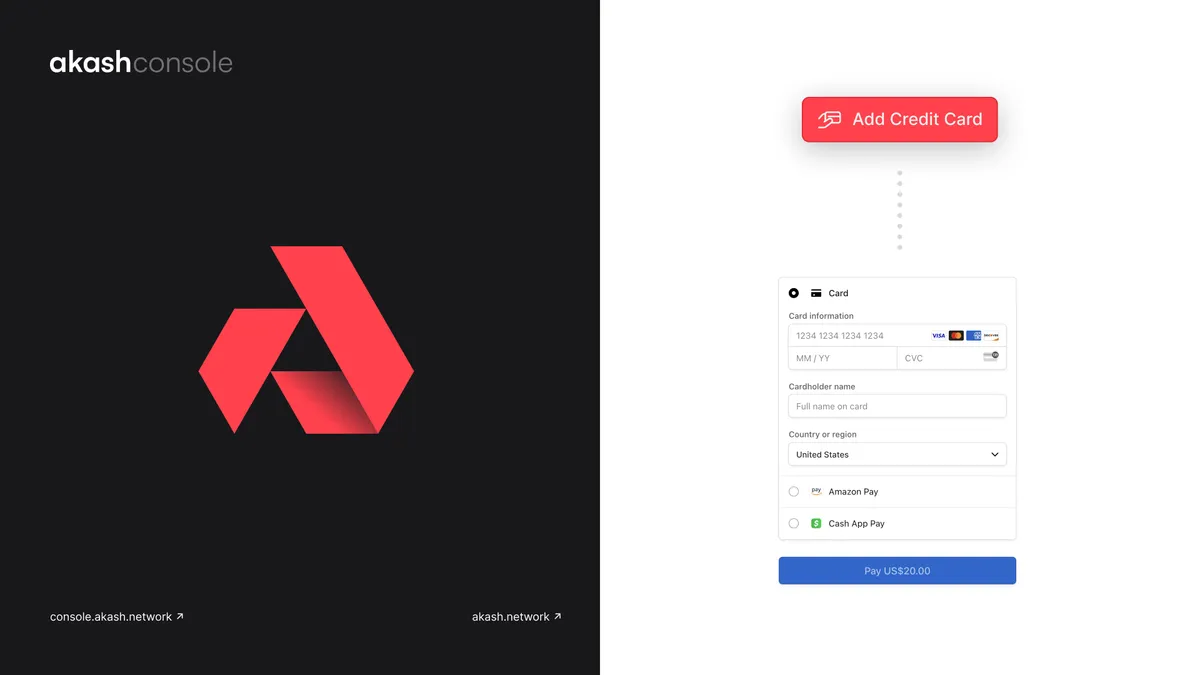

Step 2: Get Money Into The Cryptoverse

Getting money into the cryptoverse is often burdensome and time-consuming. Many banks may not make it easy to shift dollars into cryptocurrency exchanges. It can take as long as 10+ days or more to initiate a bank transfer in some cases. In many cases, you will need to provide a government ID (called a KYC or Know Your Customer check).

Once your money is in the system, things get easier and much more instantaneous. The best way to get money into the cryptoverse is often via an exchange. There are many to choose from. You can see the list of largest exchanges here.

Step 3: Purchase and Swapping of Coins

Once your funds are in an exchange, you can either purchase coins directly or shift your funds from the exchange into one of your wallets. You can either choose to keep your money in an exchange or move it to one of your wallets. Once in a wallet, you can often swap the coin for other coins that look interesting using a variety of built-in or decentralized services.

A big area of development is in swapping and moving coins from one blockchain ecosystem to another. Decentralized Liquidity Providers such as Uniswap have become popular which allows users to readily exchange one token for another (with a fee). There are also a group of services building “bridges” between ecosystems to enable users to shift their coins from one ecosystem to another.

Step 4: Researching Coins & Tokens

Here is where the complexity and speed of innovation in the cryptocurrency space become a challenge for anyone wanting to get started. A general filter I use when evaluating coins to invest in looks like this:

- Strong social media activity and engaged founder.

- The rapid rate of innovation, constantly pushing out new updates.

- Strong community activity on Telegram, Discord, Reddit, Twitter.

- Not redundant tech (there are a million “liquidity provider” types, for example).

- Does the coin offer additional features such as staking or deflationary benefits?

- Look for a direct relationship with a major exchange (often important).

- Interesting and unique technology that solves a real problem.

- Strong partnerships and deal-making.

- Has a unique story or advantage.

Here is how I decide what to buy:

- I follow the coin on Reddit, Telegram, Discord, Twitter.

- I check the community activity, what are they talking about, is there anything disqualifying that I see immediately?

- I read the Reddit for that coin and learn about any upcoming news or announcements.

- Try to gauge if the community is insane or not, many of the communities tend to be highly delusional or only focused on price. If they do not have rational reasons for buying and holding, I avoid it.

- Check the Coinmarket cap for the coin, is it sub $1 billion dollars? Or less? I like to buy coins that have a market cap in the hundreds of millions before they “break out.”

There is no wrong answer for what to buy or how to go about selecting tokens or coins to invest in.

Understanding Different Algorithms and Blockchains

An important thing to understand about the current cryptocurrency ecosystem is that there are many blockchain ecosystems. A few prominent ones:

- Ethereum

- Bitcoin

- Binance

- Solana

- Cardano

- Cosmos

- Tron

Each of these blockchains represents fundamentally different approaches to solving the challenge of digital currency. Each of these blockchains also has spawned dozens or hundreds of tokens based on their respective ecosystems.

In crypto terminology, a “Coin” tends to be the fundamental unit of a Blockchain such as Ethereum, Bitcoin, Solana etc. A “Token” is a unit of exchange based on someone else’s blockchain. For example, Ethereum has thousands of Tokens such as UNI (Uniswap) based on its ERC-20 standard.

Some Terms You Might Encounter

- “Wrapped Token” A coin from one blockchain that has been packaged for sale on another blockchain. For example, I could buy “Wrapped Bitcoin” using Ethereum so I can buy, hold and sell Bitcoin without actually leaving the Ethereum ecosystem.

- “Utility Token” A token that can be used for something. For example, you could buy AVA token from Travala and use it to get discounts on travel.

- “Bridge” A big challenge in the crypto space is translating tokens or coins from one blockchain to another as there are frequently significant technological differences. Bridged allow you to do this.

- “Oracle” An oracle, in the crypto space, is a program that read a datafeed from the “real world” and transports it into the crypto world. For example, Mirror Protocol uses Oracles or Observers to track the prices of stocks like Tesla and convert them into assets which you can buy and sell that track Tesla stock in crypto space

- “CBDC” Central Bank Digital Currency. These are coins issued by governments to represent their local currency. Increasingly, major governments are considering using these as replacements for their previous systems

- “Stable Coin” This is a token or coin which is designed to track the value of $1 or other similar currency. Stable Coins come in many shapes and sizes and are often used as convenient stand-ins for dollars which can be used instead of transferring money into and out of the cryptoverse

- “Smart Contract” A piece of code which lives on the blockchain and can be used to execute programmatic behavior

- “Liquidity Provider” A service which incentivizes users to make their tokens available as the basis for “Liquidity Pools.” These liquidity pools make it possible to ensure there is always ample of supply for rarer tokens to be “Swapped” for other tokens.

- “DAO” A decentralized autonomous organization. It has become increasingly popular to launch autonomous organizations which are run programmatically in a distributed fashion. A popular example is the MakerDAO

- “dApps” Decentralized Applications which live on the blockchain and can perform various programmatic functions

- “DeFi” Decentralized Finance, a growing movement towards shifting finance to smart contracts, DAOs, blockchains and dApps

- “NFT” Non-Fungible Token. A token which represents a digital good such as a JPEG. Ownership of an NFT is tracked via the blockchain, they can be bought and sold

Closing Thoughts

That’s it for now. Once again, this is a rapidly evolving space and new innovations and trends are occurring every day. I recommend spending significant time joining and researching the many online chats and communities available to gain a more recent understanding and keep your knowledge up to speed with the market.